Το Forum του Ωδείου Μουσική Πράξη

Για Μένα

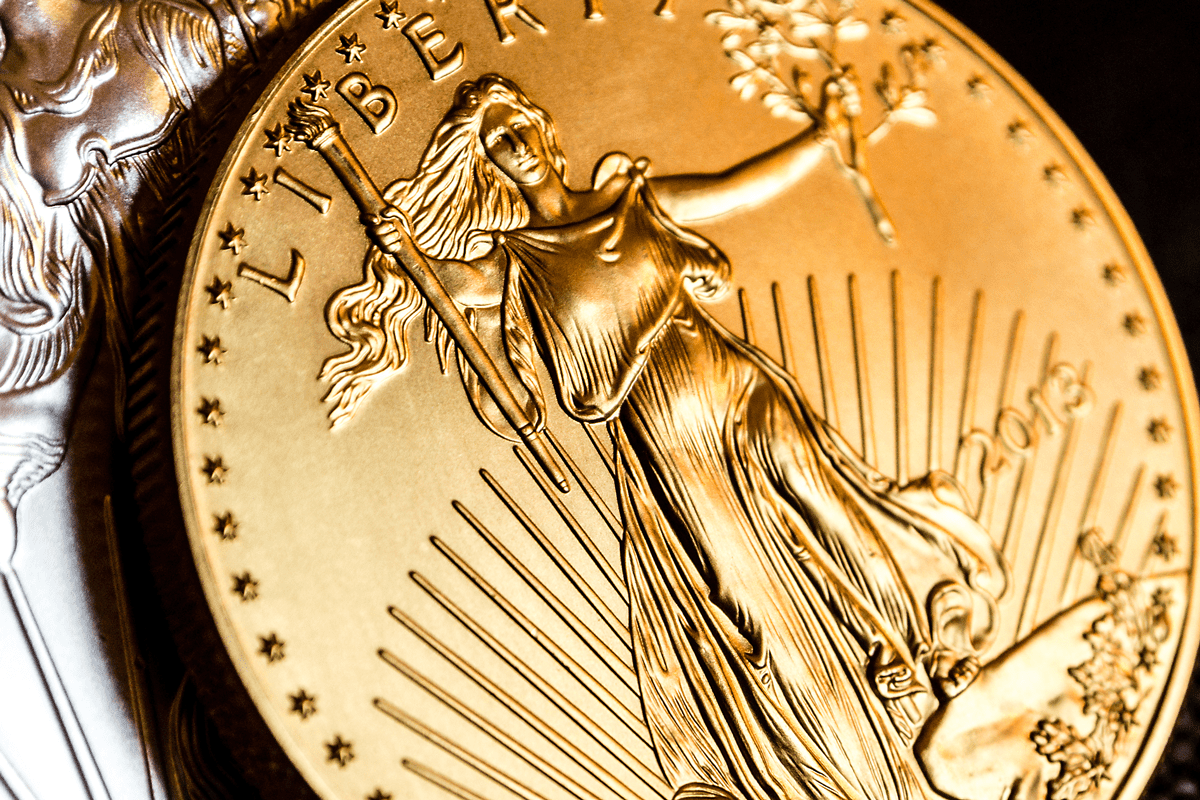

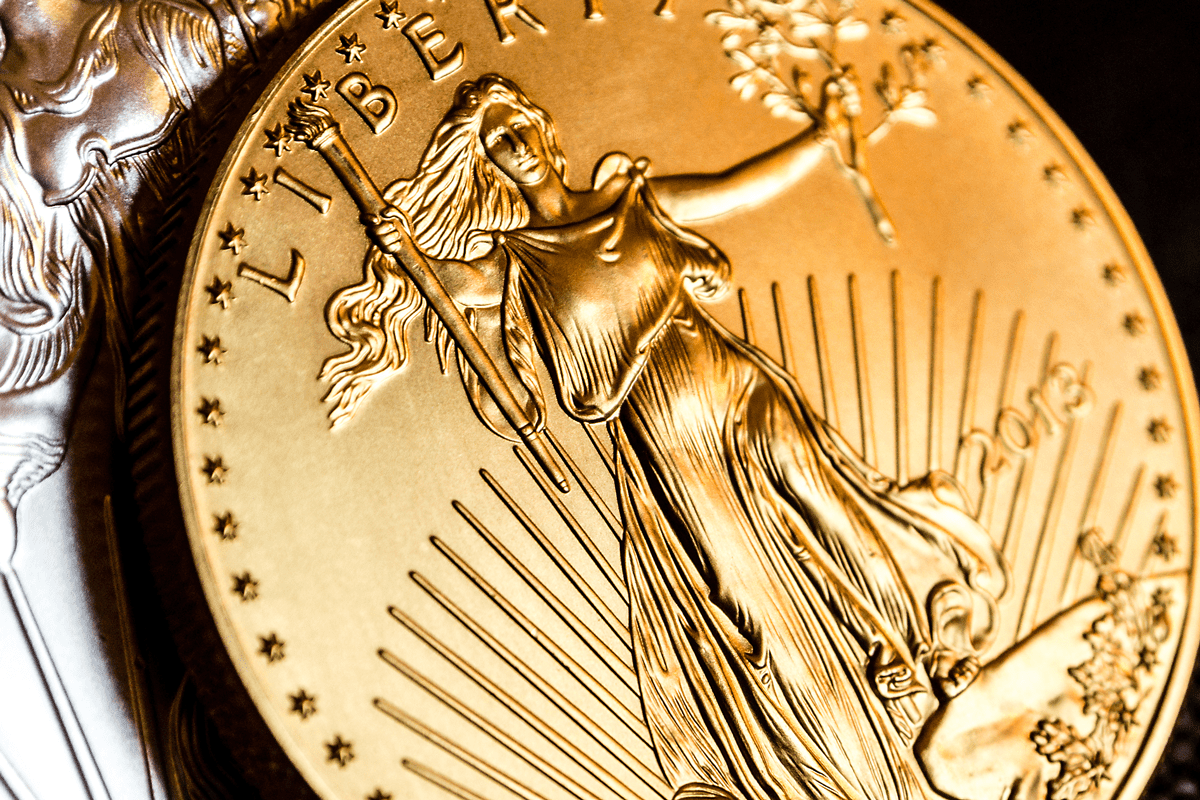

It’s a big number, however not massive sufficient to clarify how compelling it's to hold a 1 Kilo Gold Bar. In order to be eligible as gold in IRA, a gold coin must be 99.5% pure or .999 positive within the language of treasured metals. Probably the mostly known type of gold investing is buying bodily coins or bars from coin dealers. We convey gold bars and coins utterly protected to our American prospects all by the US from our retailer accomplice vaults in Delaware. For 2020, quick-term good points from selling mining stocks held in your taxable brokerage agency account are topic to a maximum federal charge of 37%. Both long-time period positive aspects and brief-term good points can also get hit with the 3.8% NIIT, and state revenue taxes could apply too. If you cherished this article and you also would like to get more info concerning The Best Gold Ira Companies (Www.Alopexgold.Com) please visit our own website. The timing for when you need to start taking your required minimal distributions (RMDs) from a standard gold IRA is determined by your age or start 12 months. Regardless of the danger, Moy believes there is a reason to take a position retirement funds in gold.

A Sinn Féin MP has told an IRA commemoration that everyone has "the suitable to remember, and the best to commemorate". John Finucane was the primary speaker at what has been billed a "South Armagh Volunteers commemoration". Avellino complained to the presiding Federal Judge, John E. Sprizzo, that Price Waterhouse fees had been extreme, however the choose ordered him to pay the invoice of $428,679 in full. Their face values are largely symbolic, because gold’s market value - which is reported in the market pages and Internet sites of major newspapers has traditionally been increased. Doing so will help guarantee that all features from value effectiveness to security features meet your wants - in the end resulting in a secure investment technique for the lengthy haul. The exception says that IRAs can spend money on certain gold, silver, and platinum coins and in gold, silver, platinum, and palladium bullion that meets relevant purity standards. The way to Switch Your Conventional IRA to Gold and Eight The explanation why You should Do It Today!

Though it’s technically potential to transfer all the amount out of your current retirement account to a gold funding in an IRA, this would be a extremely risky transfer. We’re speaking about your very own funds, in addition to your future after you stop working, so I’m certain you won’t make any rash and reckless strikes. Presumably when a good brokerage firm is appearing as the IRA trustee, it won’t let an IRA purchase shares in an ineligible ETF in the primary place. If it isn't an excessive amount of bother, moreover visit our data pages for added subtleties on gold and silver enterprise fundamentals, Bitcoin, and our preparations. When figuring out how a lot you plan on investing in a gold IRA, it's crucial to contemplate your retirement income wants, timeframe, and risk tolerance. Not understanding how this account features can easily lead to making errors while setting it up, errors that can take a toll in your whole investing portfolio and make you regret your determination to even do this.

Though it’s technically potential to transfer all the amount out of your current retirement account to a gold funding in an IRA, this would be a extremely risky transfer. We’re speaking about your very own funds, in addition to your future after you stop working, so I’m certain you won’t make any rash and reckless strikes. Presumably when a good brokerage firm is appearing as the IRA trustee, it won’t let an IRA purchase shares in an ineligible ETF in the primary place. If it isn't an excessive amount of bother, moreover visit our data pages for added subtleties on gold and silver enterprise fundamentals, Bitcoin, and our preparations. When figuring out how a lot you plan on investing in a gold IRA, it's crucial to contemplate your retirement income wants, timeframe, and risk tolerance. Not understanding how this account features can easily lead to making errors while setting it up, errors that can take a toll in your whole investing portfolio and make you regret your determination to even do this.

There are a lot of gold IRA companies on the market and making sure you know their distinct policies is usually a challenge. As soon as you've chosen an appropriate custodian, open up the new Gold IRA account and make sure all paperwork are correctly crammed out and filed with the inner Revenue Service (IRS). Once you’ve chosen a custodian, you need to open a self-directed IRA account. Switch: When you have an present Gold IRA, you may switch it to the new custodian. The first step when setting up a gold IRA is choosing an IRS permitted custodian that provides such accounts.

Τοποθεσία

Επάγγελμα